|

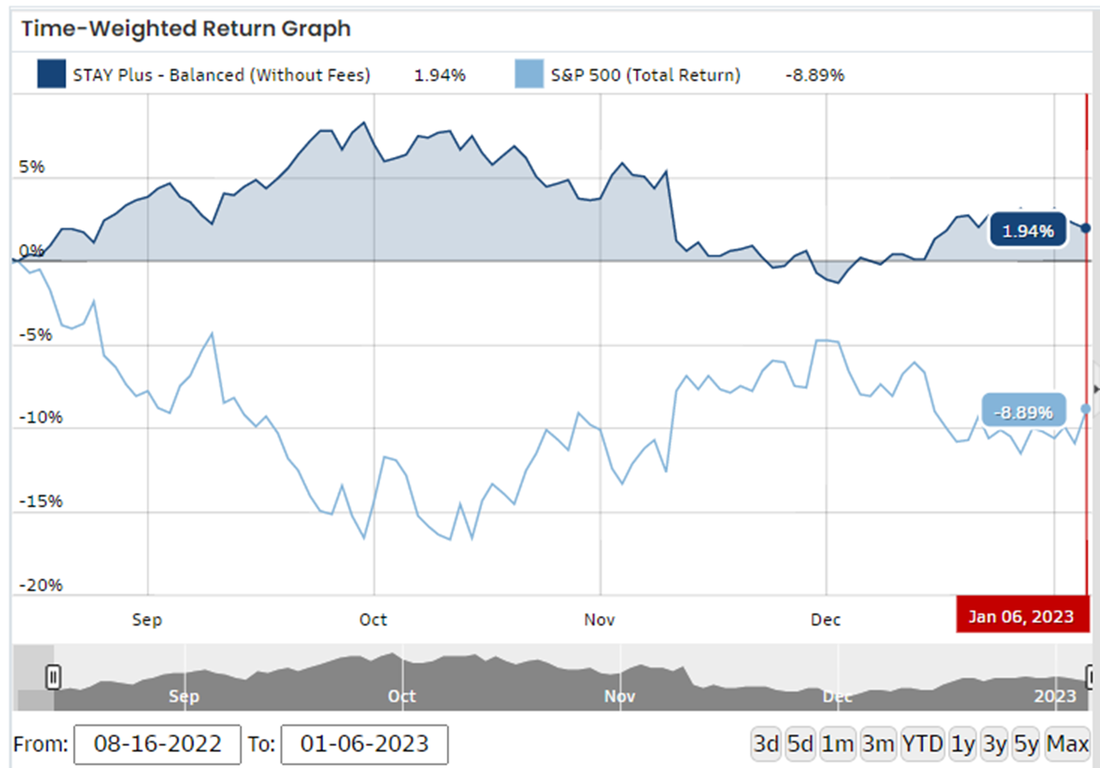

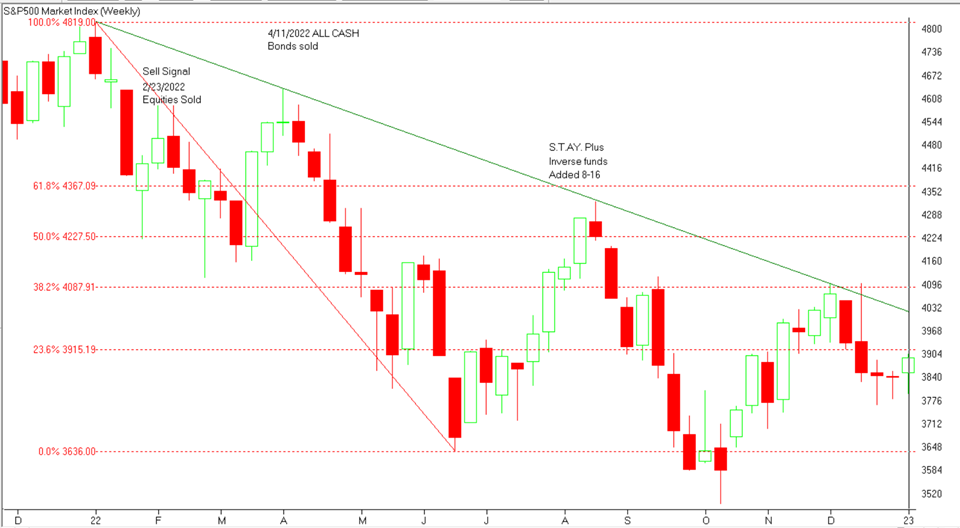

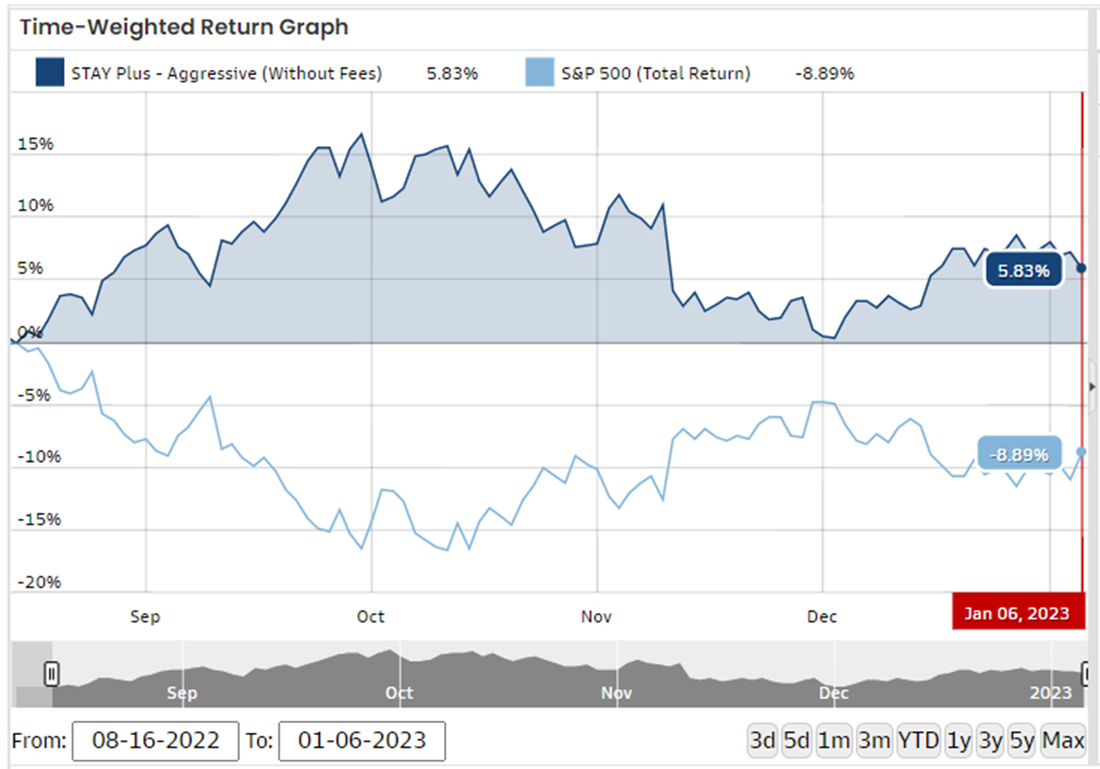

Current position for Active portion of portfolio: SELL – S.T.A.Y. Plus™ 2022 ended the worst stock market since 2008. Further, 2022 saw the worst Bond price drop in one year, ever. Bonds which traditionally for over the last 50 years or more have served as the “safety net” for portfolios in down markets were down over *27% (*BLV, Vanguard Long Term Bond Index Fund). The safety “rule of thumb” implemented by age targeted funds (over half of all 401k investments) was to hold the percentage of bonds in your portfolio that matches your age, so that the older you get, the safer your portfolio is, i.e. 60 years old, 60% bonds, 70 year old, 70% bonds, etc. This rule of thumb was extremely devastating to buy and hold portfolios this year, especially for the older investors. Following that was the Nasdaq down -32%, followed by the S&P500 at -18%, followed by the Small Caps at -16%, followed by the Midcaps at -13%. Making the average of the four equity indexes a -20.32% for the year, which makes any mixture of stocks and bonds in a “buy and hold” portfolio a very dangerous bet for 2022 and likely for 2023 as well. There were about four bear market rallies of various sizes last year, each of the counter-trend rallies retraced about 50% to 61% of the previous decline. Although some of these rallies, like June-July and Oct-November, in a Bear Market can be quite impressive, however, we are still in a definite downtrend if we continue to have lower lows and lower highs with elevated levels of volatility in both directions which persisted all year long. I would draw your attention to this week’s daily and weekly charts. The green line that is drawn from the all-time high of 4819 at the beginning of 2022 and drawn in line with the peaks of each of the larger counter-trend rally is a great visual of the downtrend. So far, this year has been a “text-book” example of the definition of a downtrend – Lower Highs and Lower Lows. Therefore, we are going to stay invested in the inverse of this downtrend until the data proves otherwise. Furthermore, all three of our monthly indicators are still significantly negative, so we are still in a solid SELL signal. Having been out of equities (stocks) since 2/23/2022 and then removing bonds going to ALL-CASH since April 11th, August 16th, we engaged the first element of the S.T.A.Y. Plus™ strategy, the equity inverse funds. Since then, the market has been down about 19% at its lows. This is exciting when markets have been moving down, the S.T.A.Y. Plus™ portfolios were moving UP! Of course, during bear market rallies the opposite is true, however, as long as we continue in a downtrend the inverse should again serve us well in the intermediate to longer term time frame. We also are scaling in the first application of the second phase of the S.T.A.Y. Plus™ strategy. We will keep you posted on those results in future reports. Also, of historical significance, we are continuing to see the pattern of 2007/2008 play out... click here to revisit the market quiz post with updated charts depicting this.

Comments are closed.

|

208.376.0091Disclaimer: past performance is not a guarantee of future performance. © Copyright - Advanced Financial Solutions, Inc.

|