|

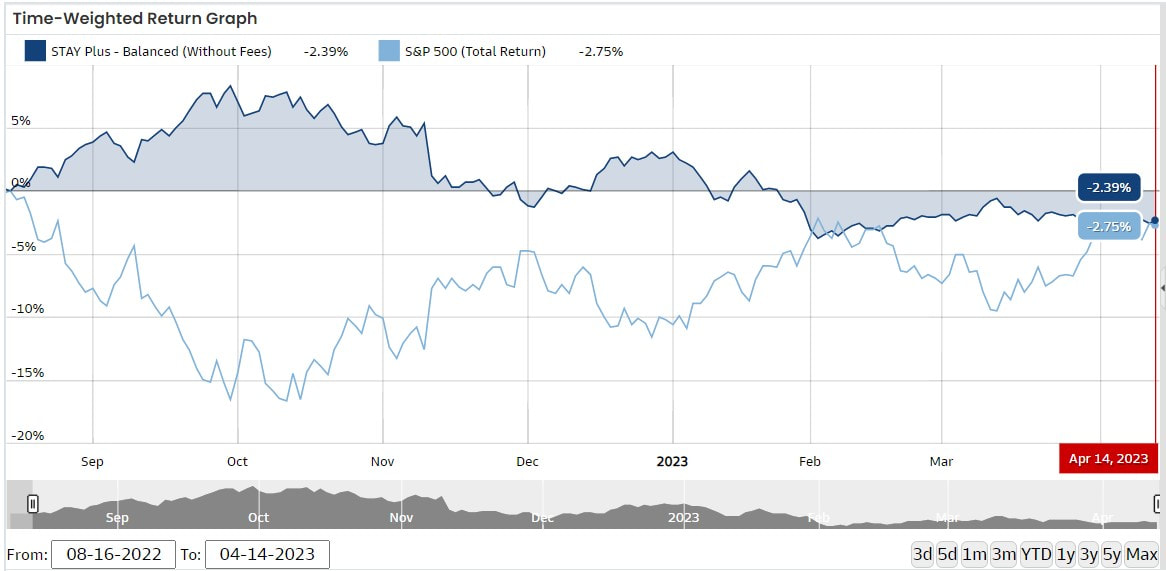

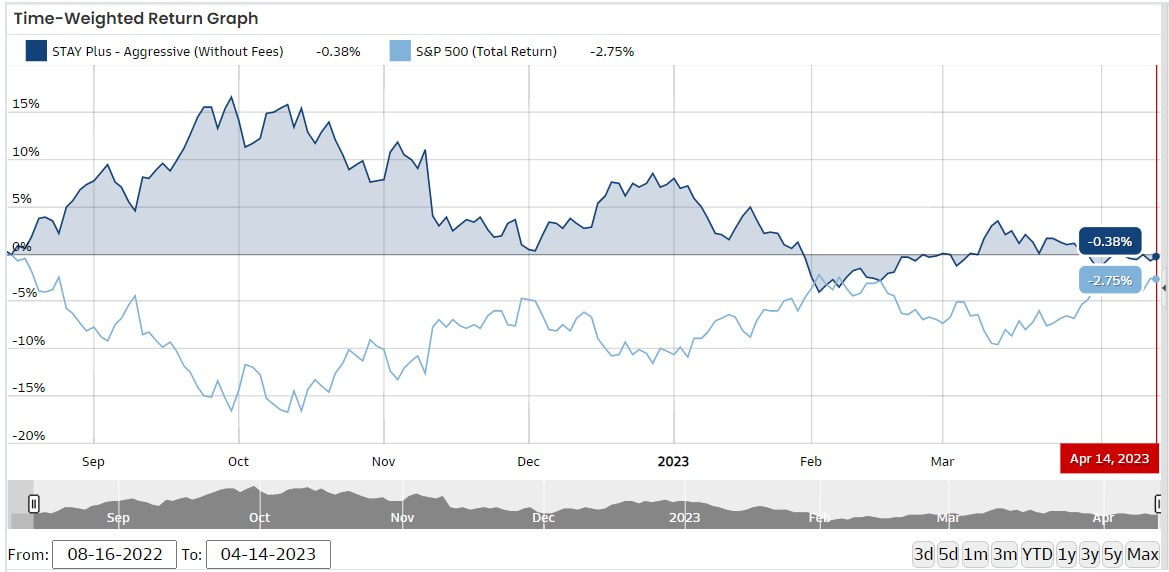

Current position for Active portion of portfolio: SELL – S.T.A.Y. Plus™ Heavy Market Extends It's Sideways Push No significant new information from the last 2 weeks, other than this sideways push adds more probability to the downside. Charts have been updated. Bear markets consist of impulsive moves down followed by weaker attempts to rally. These subsequent attempts to rally usually retrace between 50% to 60% of the downturn before heading down again. This pattern often continues in a five-wave sequence with three impulsive down waves and two corrective correction waves. On a large scale for this bear market, it appears that the first impulsive wave down started at the beginning of 2022 and for nine months bottoming out in October of 2022. Since then, we have been in a six-month complex corrective wave that so far has retraced a little over 50% of the decline from Jan 2022 to October 2022. Sometimes those corrective bear market rallies are a simple zigzag (Up-Down-Up) move, which in technical analysis terms, we call “simple” corrections. Or they are corrections that primarily move back and forth in a trading channel resulting in a somewhat sideways fashion (this is very easy to visualize on the monthly chart below), those are called “complex” corrections. In my opinion, for the last six months, we have been in a complex correction. Looking at the charts, they can best be described as “heavy.” The stock market has the “look” that it could fall from the pressure of its own weight once the lower highs of this corrective wave tops. I think we are very near the end of this correction, I don’t expect this complex correction to last too much longer. And, most importantly, our mathematical indicators continue to clearly point towards a down-trending market. We will remain invested inverse to the market until market conditions dictate otherwise. We will keep an eye on this situation and keep you posted. Monthly Chart of the S&P 500 Index - 48 months Weekly Chart of the S&P 500 Index - 12 month

Comments are closed.

|

208.376.0091Disclaimer: past performance is not a guarantee of future performance. © Copyright - Advanced Financial Solutions, Inc.

|